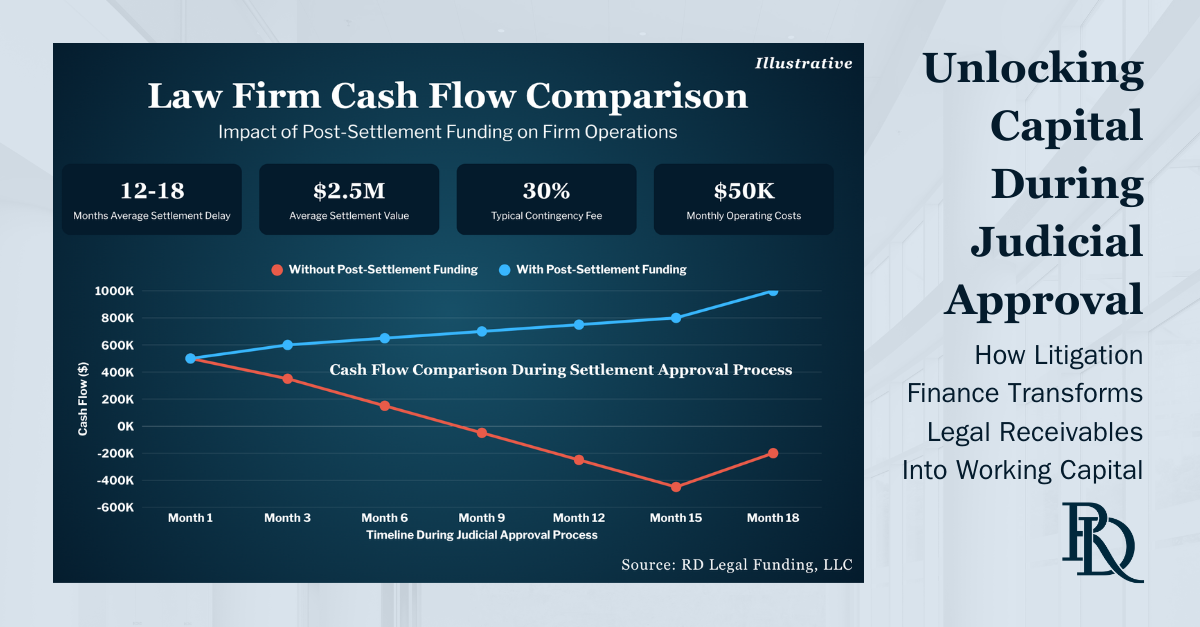

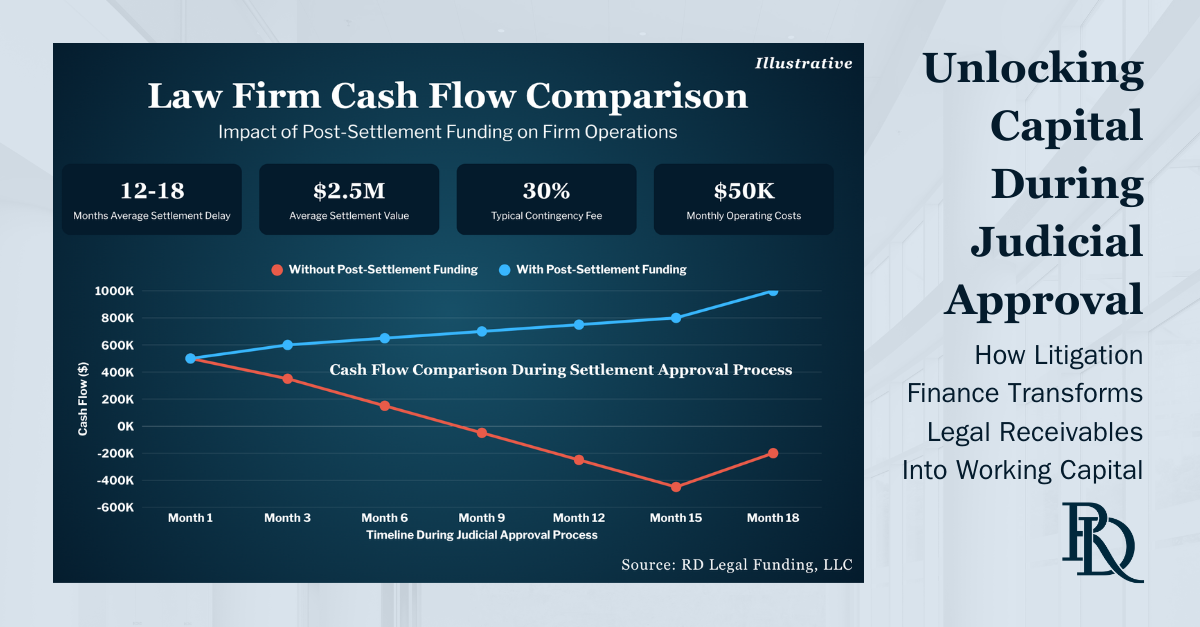

Complex litigation settlements create a paradox that many law firms know all too well: the moment of settlement announcement often marks the beginning of another lengthy waiting period. Recent industry data shows that post-settlement judicial approval processes in class actions and multidistrict litigation (MDL) can extend 6-30 months beyond the initial settlement, leaving firms with earned fees trapped in administrative limbo.

The judicial approval process serves essential protective functions, but creates significant cash flow challenges for contingency-based law firms. This procedural reality affects firms of all sizes, from boutique practices to major litigation houses managing multiple complex matters simultaneously.

The judicial approval process involves several mandatory phases that extend well beyond settlement negotiation:

Preliminary Approval Phase: Courts require comprehensive notice to all class members, a process that can often take 60-90 days depending on the size and complexity of the class.

Objection and Opt-Out Periods: Built-in timeframes allow class members to challenge a settlement and occasionally remove themselves from the settling class, adding more time to the process.

Final Approval Hearings: Courts must evaluate the fairness, reasonableness, and adequacy of the settlement through detailed review and public hearing processes.

Administrative Hold-Ups: Even after final approval, disbursement delays occur due to lien clearance, appeals periods, and administrative processing requirements.

These delays compound the financial pressure on firms that have already invested substantial resources—often spanning multiple years—without receiving compensation for their contingency-based work.

Conventional financial institutions rarely recognize contingent fees as viable collateral, creating a significant funding gap for law firms during these crucial periods. This limitation stems from traditional banking's discomfort with contingency-based revenue models and the perceived uncertainty of legal receivables.

As Roni Dersovitz, founder of RD Legal Funding, explains: "Traditional lenders struggle to understand the business of law, particularly the value inherent in earned fees from settled cases. They see contingency arrangements as risky, but we see them as valuable assets that can be converted into immediate working capital."

Litigation finance has emerged as a sophisticated solution for firms seeking to unlock value from their legal receivables. Unlike traditional lending, post-settlement funding recognizes the inherent value in earned fees from court-approved settlements and judgments.

Post-settlement funding operates on a fundamentally different principle than conventional lending. Rather than treating contingency fees as uncertain future income, specialized legal finance providers evaluate these receivables as earned assets with quantifiable value.

See an illustrative example of how litigation finance can improve your cash flow.

Key Sights:

Post-settlement funding transforms the traditional feast-or-famine cash flow cycle of contingency-based law firms into a more predictable and manageable financial structure. By converting earned receivables into immediate working capital, firms can maintain operational excellence while navigating the inherent delays in complex litigation settlements.

Sophisticated litigation funding providers conduct thorough due diligence on settled cases, evaluating factors such as:

This comprehensive assessment allows funding providers to offer competitive terms.

The advantages of litigation funding extend beyond immediate liquidity solutions. Firms that strategically utilize post-settlement funding often experience several operational improvements:

Enhanced Client Service: With operational pressures reduced, attorneys can focus on client needs and winning cases rather than cash flow management.

Improved Case Selection: Financial stability allows firms to be more selective in accepting new matters, potentially improving overall case quality and profitability.

Strategic Planning Capacity: Access to working capital enables longer-term strategic planning rather than reactive financial management.

When considering litigation finance solutions, firms should evaluate providers based on several key criteria:

Industry Expertise: Providers should demonstrate deep understanding of legal practice economics and settlement processes.

Flexible Terms: Funding arrangements should accommodate the unique timelines and requirements of different case types.

Transparent Pricing: Clear fee structures and terms allow for informed decision-making.

Reputation and Track Record: Established providers with strong industry relationships offer greater reliability and professionalism.

Successful integration of litigation funding requires careful planning and consideration of firm-specific factors. Partners should evaluate their current cash flow patterns, typical case timelines, and operational requirements when developing funding strategies.

Litigation funding works most effectively when integrated into broader financial management practices. Firms should consider developing policies around:

The judicial approval process will continue to create timing challenges for contingency-based law firms. However, sophisticated litigation funding solutions now provide viable alternatives to traditional lending, allowing firms to unlock value from their earned receivables while maintaining operational flexibility.

For firms managing complex litigation portfolios, post-settlement funding represents a strategic tool for financial optimization rather than merely a stop-gap solution. By converting legal receivables into working capital, firms can maintain growth trajectory while navigating the inherent uncertainties of the judicial approval process.

Ready to explore how litigation funding can optimize your firm's financial strategy? Contact RD Legal Funding at (800) 565-5177 or info@legalfunding.com to discuss customized solutions for your post-settlement funding needs.